Are you using old spreadsheets to keep track of your rental expenses? Worse yet, do you just have a folder of receipts at the end of the year? I’m sure you or your accountant hates this at tax time. Bookkeeping is a tedious but important task for your landlord business. REI Hub (Visit Site) created this software to make this process as easy and accurate as possible.

REI Hub – Set Up

Setting up REI Hub was really easy. Adding properties, tenants, and lease details was simple. We were just testing the system, so we didn’t enter initial bank balances or things like this. However, the whole system was pretty easy, and REI Hub was quick to respond to any questions that we had.

REI Hub – Usage

Entering transactions is another process that’s simple with this software. Enter rent received. Enter any maintenance expenses. The software also tracks property management info, so you can keep track of your management fees. You can use this feature whether you self-manage or use a management company.

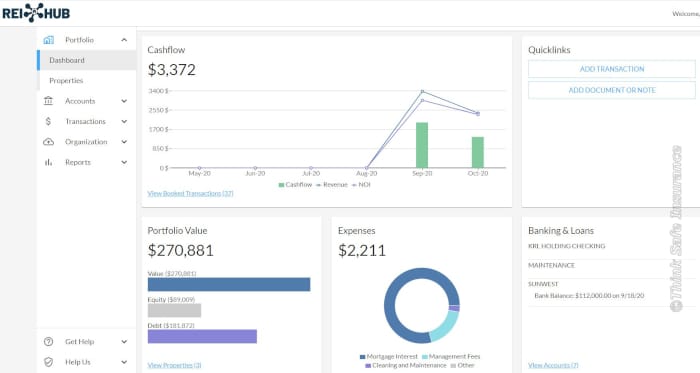

Portfolio Dashboard

When you first log in, you will see your portfolio dashboard. This shows your monthly cashflow for the last 6 months. It also shows your overall portfolio value, equity, and debt. Monthly expenses for the portfolio are also shown. This is a great snapshot of your portfolio performance.

The additional tabs on the left are:

- Portfolio – Main Dashboard, Properties

- Accounts – Banking & Loans, Property Management, Fixed Assets

- Transactions – Revenues, Expenses, Booked Transactions, Import Feed

- Organization – Leases, Documents & Notes, Contacts

- Reports – Income (P&L), Cash Flow Statement, Schedule E, Balance Sheet

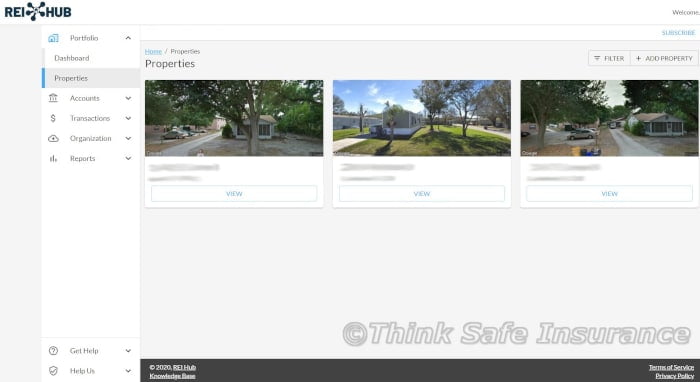

Properties

When you click on Properties on the left, it brings up each property. This is where you can add additional properties as well. In our portfolio, we have single family homes as well as multi-family buildings. For multi-families, it will show the property once here. When you click “View”, you will get a breakdown by unit. A Google Streetview image is automatically added, which I thought was a nice touch.

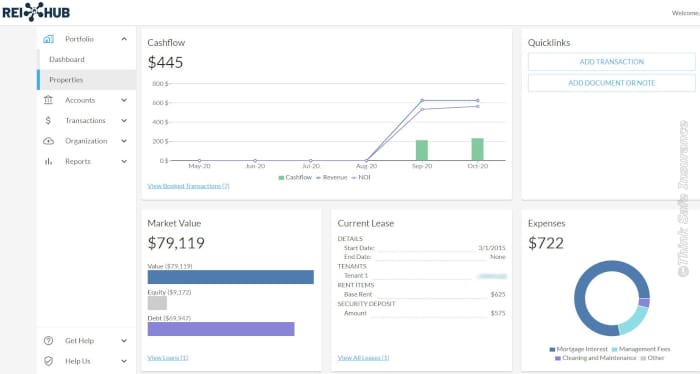

Individual Property

Here is where I think REI Hub does a great job and is useful. Other tools are available for this, but it’s more complicated to track and not as easy to view the results. With this software, it’s a few clicks to view a specific property’s performance.

This example is one of our smaller rental houses. It has similar info as the Portfolio Dashboard, but it’s specific to this property. In addition, you can see the lease details including: start/end date, tenant, rent, and security deposit.

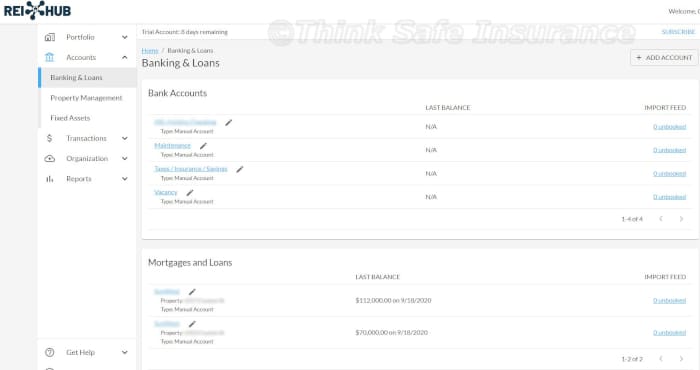

Accounts

Accounts can be setup manually, or you can actually link them to your financial institution. This allows transactions to be automatically downloaded so you simply have to assign a type for it. This will show Bank Accounts, Mortgages, and Credit Cards. This will show your balance for each account as well.

There is also a section for Property Management. You can use this whether you are managing your own property, using a property manager for your property, or managing someone else’s property. Accounting is a little different for each scenario, and REI Hub has a tutorial section or you can email them for assistance getting things set up if there are any questions on this.

Transactions

The transactions screens will show you entered transactions for revenue and expenses for all properties.

New Transactions

You can enter new transactions from the Portfolio Dashboard, Property Dashboard, Account screens, or the actual Transactions screens. This is similar to a checkbook, where you just input any income or expense you had. You will assign it to a property and assign it an account (Income – Rent, Expense – Insurance, Expense – Maintenance, etc.) The information from these transactions is what generates the Property Dashboard and Portfolio Dashboard reports. Again, by linking your accounts, it makes this process much easier, too.

Organization

You can view and add additional lease information on the Organization screen. There’s also a place to add contacts. This is handy if you have plumbers, electricians, etc and you want to keep them here in case you don’t have your cell phone contact nearby.

Reports

This section will give you the basic reports that you need for proper accounting. You can access your Income Statement (Profit & Loss), Cash Flow Statement, Schedule E, and Balance Sheet. Each of these can be adjusted for the whole portfolio or specific properties. You can also adjust the timeframe shown on the report.

Conclusion – REI Hub

If you don’t have a bookkeeping software yet or you’re using spreadsheets, REI Hub is a great way to get organized and keep track of your portfolio’s performance. The system is simple, easy-to-use, and accurate. There are a few small things to learn. Setting up properties and tenants is very easy. Setting up bank accounts is a little more involved if you aren’t using the download options. Overall this is a great system if you don’t want to dive all the way into QuickBooks which is a little more detailed, but takes a lot more to get set up properly for rental businesses. Outside of those 2 options, you may also want to consider a full property management software like RentRedi.

To learn more or sign up for a free demo, visit REI Hub’s website here. Also, one way to increase your portfolio’s performance is to lower your expenses. If you haven’t reviewed your florida landlord insurance lately, our team at Think Safe Insurance would be glad to help you. You can request your FREE policy review with our team, and we will even send you a free review checklist so you know what we will be going over.